Real Estate Making an investment For Novices

Property expense is surely an excellent approach to increase your earnings source, before diving in it's essential to carefully look at several aspects including training, time, contacts and confidence.

Add property assets to your expense portfolio for many pros. They are able to broaden and decrease risks.

Buying a Home

Beginners in actual property investing should grow to be informed about their possibilities and the various methods for starting up. There are various types of property expenditure possibilities, such as purchasing or renting components and also purchasing REITs each might require far more job dependant upon its difficulty, but all are great ways to start real estate property investment.House getting for real estate expense is among the least complicated and many efficient strategies accessible to home buyers. By looking out properties appropriate for restoration in your local area at low prices, buying them and renovating them quickly you are able to enter in real estate property investment without taking on massive down monthly payments or repair fees. When searching for components to get it's also wise to contemplate your potential audience: as an illustration working on properties near excellent university areas or areas can help filter your concentration considerably.

Turnkey leasing qualities give another means of investing in property. These solitary-household and multifamily houses have been remodeled by a smart investment residence company and therefore are ready for rent, making this kind of real estate property buy ideal for first-timers without the sources to renovate qualities them selves.

Property shelling out for novices gives several desirable positive aspects, one particular becoming being able to produce cashflow. This refers back to the net income after home loan payments and working expenses have been subtracted - it can help include home loan payments while minimizing income taxes due.

REITs and crowdfunding provide two practical expenditure selections for first-timers planning to enter property, respectively. REITs are property expense trusts (REITs) exchanged on stock exchanges that individual and deal with property properties these REITs give a safe way of diversifying your collection whilst helping meet financial desired goals more quickly than other forms of making an investment. In addition, their prices can be acquired for relatively simple sums of cash producing REITs an ideal way to begin committing for novices.

Buying a Commercial Residence

When choosing professional property, traders should understand that this type of expenditure may vary considerably from buying household real estate. When selecting where you are and with the risk endurance and objective for investing, neighborhood zoning regulations also must be taken into consideration as an illustration if utilizing it for company use this can affect reselling ideals along with hire potential.In contrast to household real estate assets, buying business attributes consists of better hazards and requires extensive study. They tend to be complicated with higher cashflow needs compared to one-family houses moreover, there can be various fees such as loan costs, residence fees, insurance costs, fix estimates, administration charges or routine maintenance estimations - these expenses can rapidly mount up therefore it is extremely important that this expert evaluates the industry before making an investment.

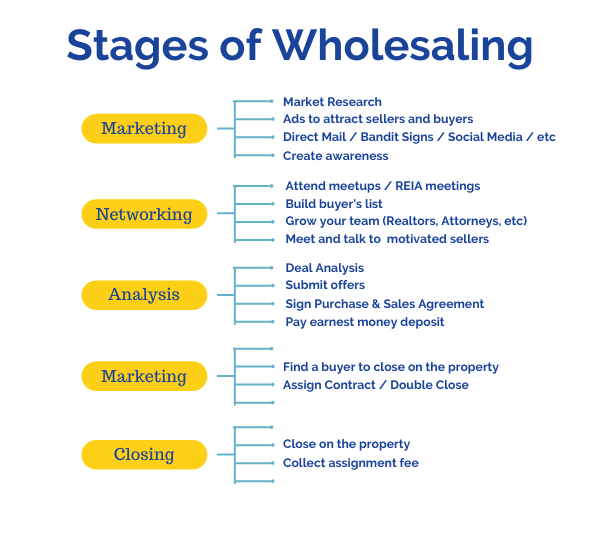

Commencing your employment in industrial residence entails while using skills of the skilled broker or realtor. They may help in discovering you with a house that greatest fits your needs and spending budget, and assist with due diligence processes when needed. Well before investing in a property additionally wholesale houses it is vital to comprehend its local taxation legislation ramifications as well as understanding how to determine cap amount and income estimations.

There are six major ways of buying real-estate: immediate expense, REITs, REIGs, property syndication and crowdfunding. Every single way of real estate investment possesses its own pair of positive aspects and obstacles when selecting one particular you must also decide if you intend to buy/change/manage/outsource the job.

As a novice in real estate committing, a brilliant method can be to get started on by using existing equity as make use of. This method saves both time and expense mainly because it reduces the hassle of getting bargains yourself when supplying you with exposure to business criteria well before acquiring your own personal properties.

Buying a Rental Residence

Among the best real estate property investing techniques for novices is getting hire properties. Leasing out house supplies an effective way to build residual income whilst potentially becoming extremely lucrative nonetheless, newcomers should keep in mind that getting rental house could be dangerous venture. They ought to carry out a in depth marketplace and location assessment before making any final decisions for instance they ought to consider factors like offense prices, college zones and saturation of stock inventory with their location since this will let them steer clear of dropping cash or overpaying for qualities.First-timers in real residence expense should look for small, more secure assets as a starting place, for example purchasing a one-household residence or condominium in the harmless neighborhood. They should seek out components with possibility of long-term development to expand their purchase profile gradually after a while.

Take into account that property purchases demand both effort and time to successfully deal with. As this could be difficult for beginning investors, it is vitally important that they have entry to a assist network consisting of property managers, lawyers, an accountant, building contractors, and so on. Furthermore, newcomers should go to as many network occasions as possible to meet other professionals with their market and locate their niche.

Eventually, possessing a in depth policy for each and every property you possess is vital. Doing this will enable you to keep an eye on income inflow and outflow associated with renting in addition to when it can be helpful to remodel or up grade them - ultimately aiding increase your return.

Property can seem similar to a difficult challenge, yet its benefits may be significant. Not only will real estate property give you continuous streams of revenue but it is also a great diversifier for your personal retirement life profile, reducing chance by diversifying from stocks that accident when often charging under other long-term assets.

Investing in a REIT

REITs supply investors use of real estate without the need to acquire specific properties, whilst supplying greater brings than traditional fixed earnings assets for example bonds. They may be a very good way to diversify a profile however, traders need to ensure they completely understand any related risks and choose REITs with recognized path information.There are many sorts of REITs, each and every making use of their personal group of unique characteristics. Some focus on mortgage loan-backed securities that may be highly erratic other folks personal and manage commercial real estate for example offices or shopping malls and others personal multiple-family hire flats and manufactured real estate. A number of REITs are even publicly dealt on inventory swaps letting brokers to directly purchase gives other nonpublicly dealt REITs may be reachable through individual equity money and broker agents.

When selecting a REIT, make certain it provides a eco friendly dividend that aligns having its income history and management crew. Also remember the health risks involved like possible house importance fall and interest rate alterations along with its overall come back and quarterly dividends in addition to its yearly running earnings.

REITs typically disperse dividends as ordinary revenue rather than investment capital benefits for their traders, which can demonstrate helpful for anyone in decrease tax brackets. It's also worth recalling that REITs may supply much better opportunities than direct real-estate making an how do i invest in real estate investment for newcomers to real estate making an investment.

NerdWallet can assist you decide on an REIT ideal for your expenditure requirements by assessing broker agents and robo-experts on the web, considering fees and minimum requirements, purchase possibilities, customer support abilities and mobile app characteristics. Once you see 1 you enjoy, REIT purchases can begin just remember they're long-term assets which need checking periodically moreover mortgage REIT prices often increase with increasing interest rates this craze helps make house loan REITs especially erratic purchases.